Grid trading bots have taken center stage in the crypto passive income conversation, especially as we move into 2025’s more mature DeFi landscape. What’s changed? The rise of AI grid trading bots has made it easier than ever to automate profits from micro price swings, if you know how to deploy them strategically, manage risk, and keep your settings sharp as markets evolve.

Why AI Grid Trading Bots Shine in Sideways Markets

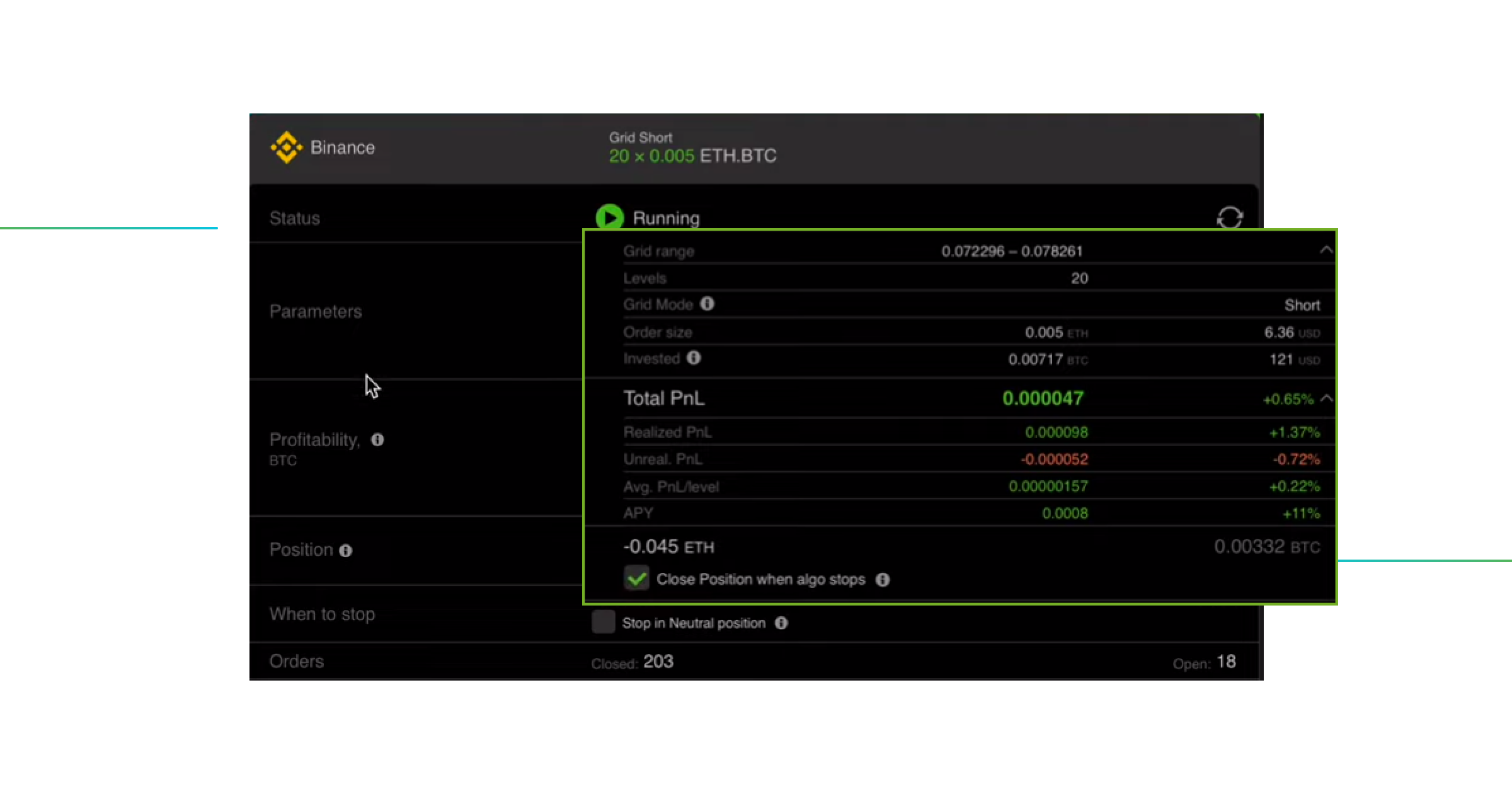

The core strategy for maximizing passive income with these bots is simple but powerful: Deploy AI Grid Bots in Sideways or Range-Bound Markets. In 2025, the best results come from configuring your bot to operate within a clearly defined price range, think Bitcoin or Ethereum chopping between support and resistance, not trending up or down aggressively.

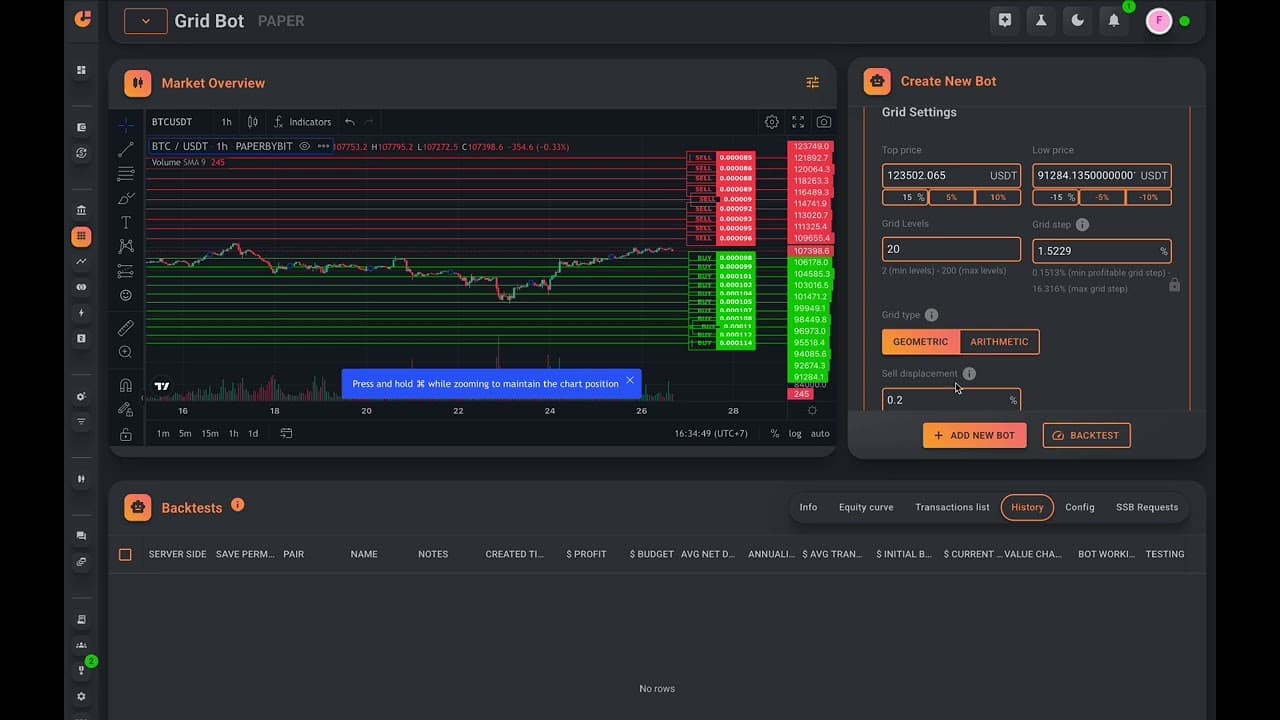

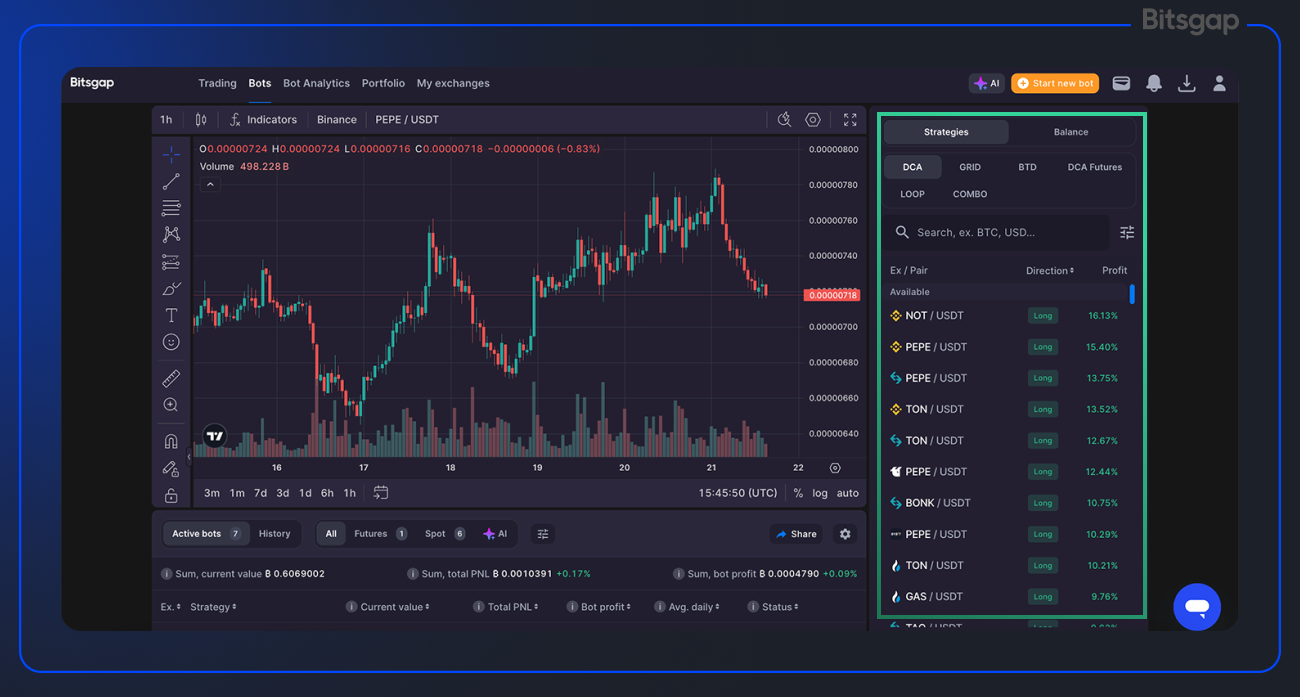

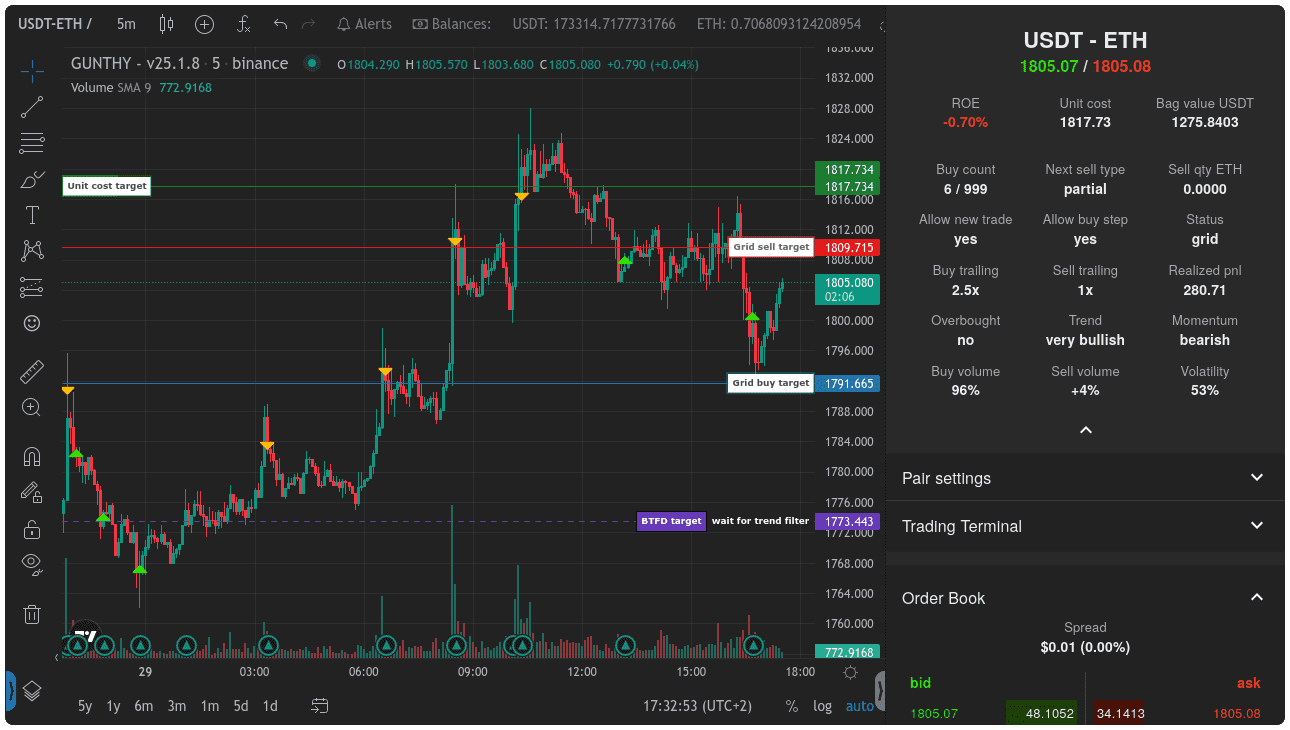

This approach works because grid bots set up a series of buy and sell orders at regular intervals above and below a central price. When the market bounces back and forth (as it often does during periods of uncertainty or consolidation), your bot automatically buys low and sells high, capturing small profits over and over. AI takes this up a notch by dynamically adjusting grid spacing, order sizes, and even integrating technical indicators like MACD or Bollinger Bands to fine-tune entries and exits. Platforms like Gainium and Cryptohopper are leading examples of this evolution (see research on dynamic grid adjustment).

The Hidden Danger: Sudden Volatility or Breakouts

No strategy is bulletproof, and with automated grid bot strategies, the Achilles’ heel is clear: Sudden Volatility or Breakouts. If news hits or whales push prices rapidly out of your set range, your bot may rack up unhedged positions that spiral into losses instead of gains. This is particularly risky if you’re running a tight grid on assets that are prone to sharp moves (think meme coins during hype cycles).

Even the most advanced AI can’t predict black swan events, but it can help manage risk by integrating stop-losses and position size limits. Still, traders need to be vigilant about their exposure when volatility spikes. For more insights on handling these risks, check out Equithy’s guide on automated trading bot risks.

Top Strategies, Risks & Best Practices for AI Grid Bots

-

Strategy: Deploy AI Grid Bots in Sideways or Range-Bound Markets – Maximize passive income by configuring AI-powered grid trading bots to operate within clearly defined price ranges. This approach takes advantage of frequent small price movements typical of sideways markets, allowing the bot to buy low and sell high repeatedly for steady gains.

-

Risk: Sudden Volatility or Breakouts – Grid bots can incur significant losses if the market rapidly breaks out of the set grid range due to unexpected news or high volatility. Such events may cause positions to accumulate unhedged losses, especially if the bot isn’t configured with proper risk controls.

-

Best Practice: Regularly Adjust Grid Parameters and Monitor Bot Performance – Continuously review and optimize grid spacing, upper/lower limits, and investment allocation based on real-time market data and trend shifts. This ensures your bot adapts to changing conditions, maintains optimal performance, and effectively mitigates risk.

Best Practice: Regularly Adjust Grid Parameters and Monitor Performance

The biggest mistake I see new users make? Setting their bot once and forgetting it, especially when markets shift gears overnight. The best practice for sustainable returns is straightforward but non-negotiable: Regularly Adjust Grid Parameters and Monitor Bot Performance.

This means continuously reviewing your bot’s performance stats (profit per trade, win rate, drawdowns) as well as real-time market data. Are you still operating in a sideways market? Has volatility increased? Should your upper/lower limits be expanded, or should you tighten them as liquidity dries up? Proactive tweaks based on live conditions keep you ahead of strategy decay (see IEMLabs’ advice on continuous monitoring). This approach not only protects against losses but also ensures you’re squeezing every bit of efficiency from your automated system.

Seasoned traders know that even the smartest AI grid trading bot can’t be left on autopilot for months without intervention. Crypto markets in 2025 are more dynamic than ever, with liquidity flows and narratives shifting quickly. The key to thriving with automated grid bot strategies is to treat your bot like a living portfolio: adjust grid spacing, tweak investment allocations, and update stop-losses as conditions change. This hands-on approach is especially vital during earnings seasons, regulatory news cycles, or when assets suddenly trend after weeks of sideways action.

For example, if your bot was configured for Bitcoin ranging between $100,000 and $105,000 but BTC suddenly surges past $110,000 on macro news, failing to adjust your grid could leave you overexposed or missing out on new profit zones. Likewise, shrinking your grid too tightly during low volatility periods can eat into fees and reduce returns. The best AI trading bots offer real-time analytics dashboards and alerts to help you stay ahead of these shifts.

Putting It All Together: Smarter Passive Income in 2025

Let’s recap the winning formula for earning crypto passive income with AI-powered grid bots in today’s market:

Top Strategies, Risks & Best Practices for AI Grid Bots

-

Strategy: Deploy AI Grid Bots in Sideways or Range-Bound Markets – Maximize passive income by configuring AI-powered grid trading bots to operate within clearly defined price ranges, capitalizing on frequent small price movements typical of sideways markets. This approach works especially well with platforms like Binance, Cryptohopper, and Gainium, which support advanced AI grid strategies.

-

Risk: Sudden Volatility or Breakouts – Grid bots can incur significant losses if the market rapidly breaks out of the set grid range due to unexpected news or high volatility, causing positions to accumulate unhedged losses. Even with AI enhancements, bots on platforms like WhiteBIT or Good Crypto may struggle to adapt instantly to sharp market swings.

-

Best Practice: Regularly Adjust Grid Parameters and Monitor Bot Performance – Continuously review and optimize grid spacing, upper/lower limits, and investment allocation based on real-time market data and trend shifts to ensure optimal performance and risk mitigation. Use analytics tools available on platforms like Cryptohopper and Gainium for effective monitoring and adjustment.

By focusing on sideways or range-bound markets, you’re stacking the odds in your favor, these environments allow automated buy-low/sell-high cycles to play out repeatedly. But always keep an eye out for sudden volatility or breakouts that can turn a profitable setup into a losing one fast. And above all else, make it a habit to regularly review and adapt your bot’s parameters.

Curious how other traders manage their grid bots? Or want tips from those who’ve weathered both bull runs and flash crashes? There’s an active community sharing real-world lessons every day.

FAQ: Your Burning Questions About AI Grid Trading Bots Answered

If you’re ready to take the plunge into automated crypto income, or just want to level up your current approach, the most powerful advantage is knowledge. Keep learning, stay flexible with your settings, and don’t be afraid to iterate as the market evolves. With the right mix of strategy, vigilance, and tech-savvy risk management, AI-powered grid bots can become a reliable pillar of your digital asset portfolio.