Building a multi-chain AI trading bot in 2024 is no longer the exclusive domain of hedge funds or deep-pocketed quant teams. Thanks to the rapid evolution of open-source frameworks and cross-chain integration libraries, individual traders and DeFi builders now have powerful tools at their fingertips. Whether your goal is to automate arbitrage across Ethereum and Polygon or to engineer a fully autonomous AI agent that adapts to market sentiment, the landscape has never been richer with opportunity, or more competitive.

The Blueprint: Core Components for Multi-Chain AI Trading Bots

Before diving into code or model training, it’s essential to map out the architecture of a robust multi-chain trading agent. At a minimum, your stack must address:

- Exchange API Integration: Seamless connectivity with both centralized and decentralized exchanges for real-time data ingestion and order execution.

- AI/ML Model Layer: Predictive analytics powered by libraries like TensorFlow or PyTorch, capable of ingesting multi-source data streams.

- Cross-Chain Transaction Support: The ability to execute trades across different blockchains without manual intervention.

- Risk Management and Security: Automated stop-losses, position sizing, and robust access control.

The following curated list highlights the essential open-source tools and frameworks that make all this possible in today’s market.

Top Open-Source Tools for Multi-Chain AI Crypto Trading Bots

-

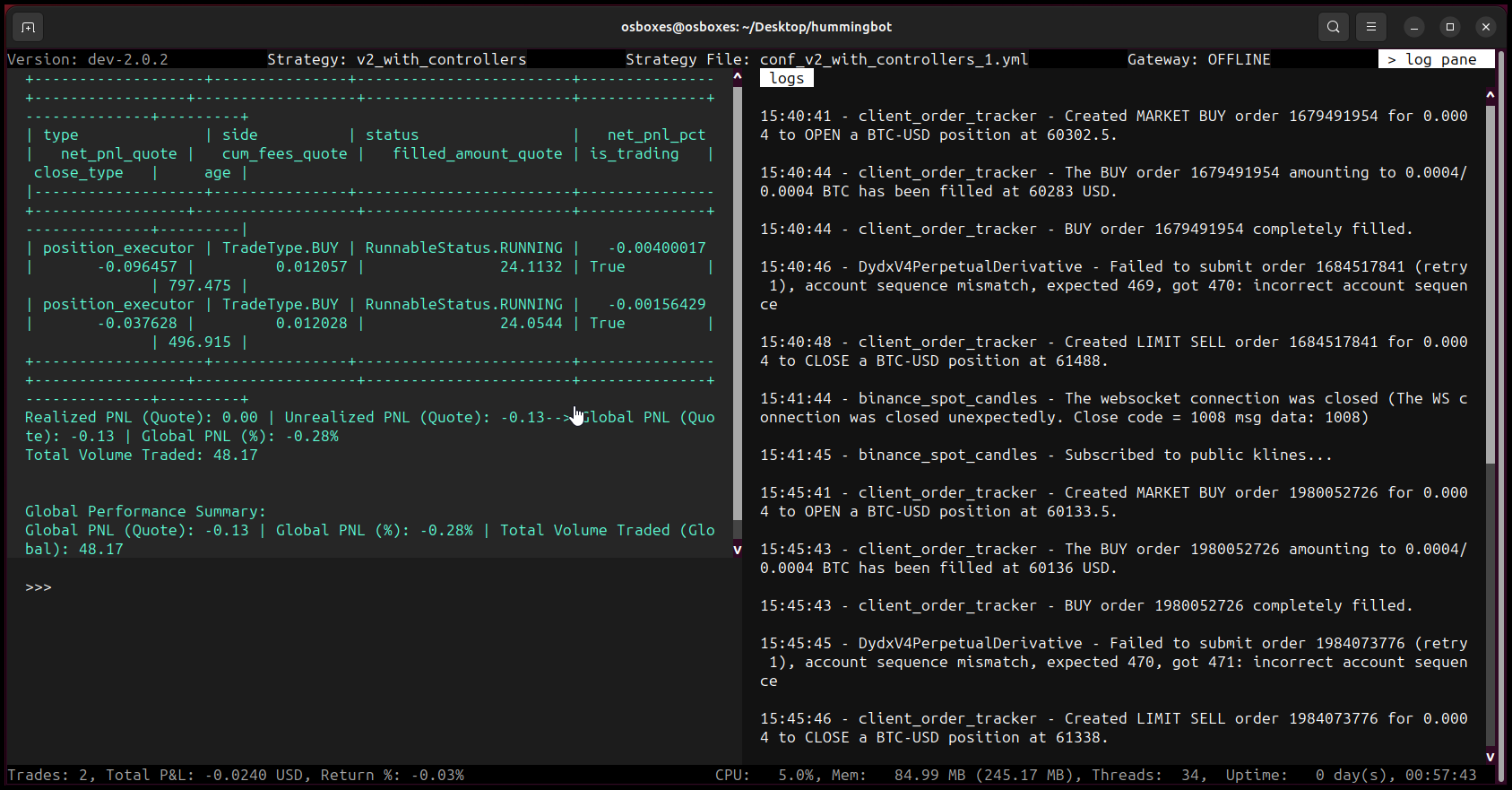

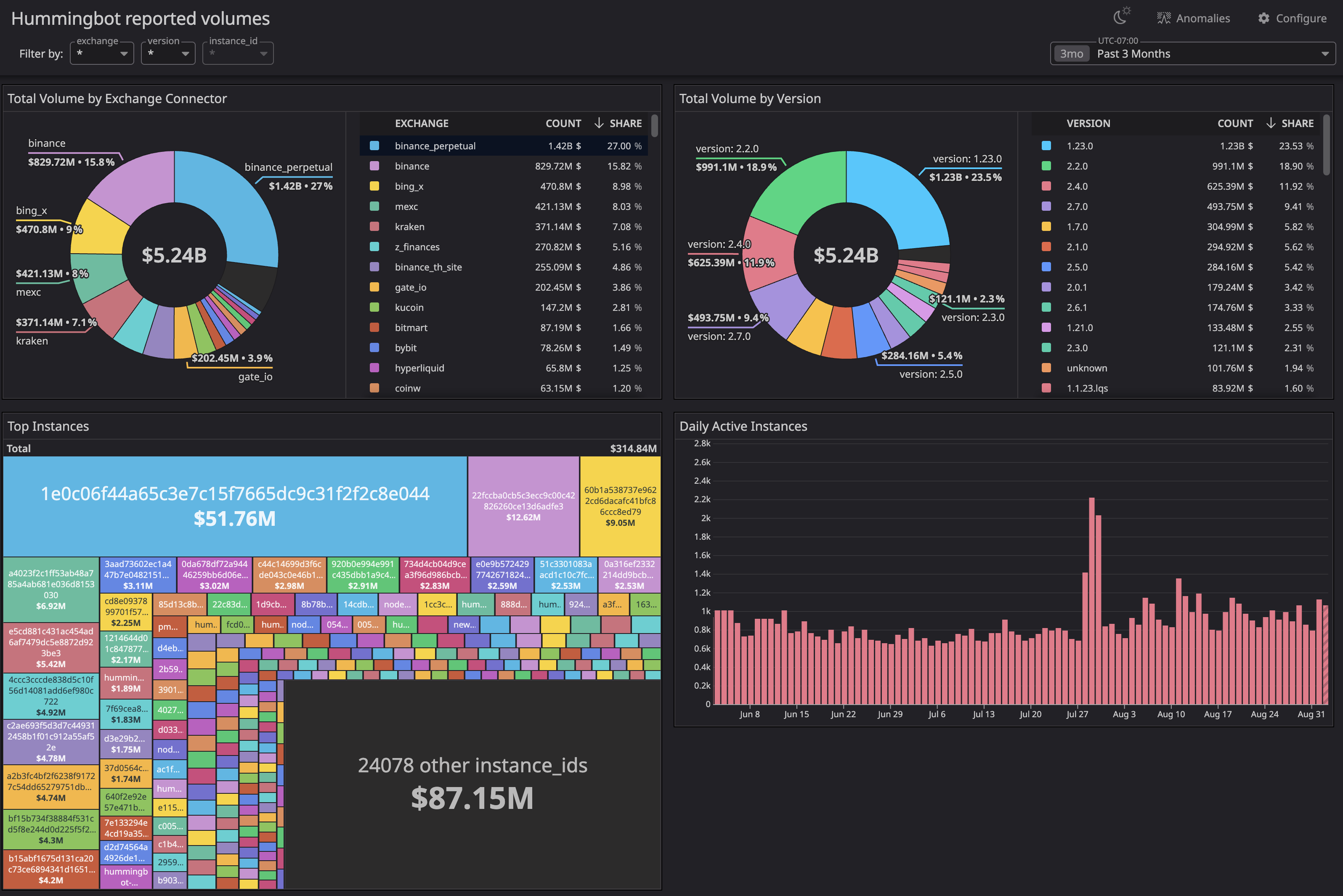

Hummingbot – An open-source, multi-chain trading bot framework that enables users to build, customize, and deploy algorithmic trading strategies across both centralized and decentralized exchanges. Hummingbot supports cross-chain operations and provides robust connectors for major exchanges, making it ideal for AI-driven, automated trading.

-

CCXT (CryptoCurrency eXchange Trading Library) – A widely-used open-source library that simplifies exchange API integration for over 100 cryptocurrency exchanges. CCXT enables seamless connectivity for bots to access real-time market data, execute trades, and manage accounts, forming the backbone of multi-chain trading systems.

-

Autonolas Trading Agents – A real-world example of AI-powered, cross-chain trading bots deployed on Ethereum and Polygon. Autonolas Trading Agents leverage decentralized autonomous services to execute sophisticated trading strategies, demonstrating live, collaborative AI agent deployments in multi-chain environments.

Hummingbot: The Open-Source Multi-Chain Workhorse

Hummingbot stands as one of the most versatile open-source frameworks for automated crypto trading. What sets Hummingbot apart in 2024 is its mature support for both centralized (CEX) and decentralized exchanges (DEX), along with native multi-chain capabilities. Developers can deploy sophisticated market-making, arbitrage, or custom AI-driven strategies directly onto major networks like Ethereum, Binance Smart Chain, Polygon, and beyond, all from a single unified interface.

The modular plugin system allows seamless integration with external machine learning models. This means you can connect your TensorFlow-based price predictor or sentiment analyzer directly into Hummingbot’s trade execution engine. For those targeting cross-chain opportunities, such as exploiting price inefficiencies between DEXs on different chains, Hummingbot’s orchestration layer is indispensable.

CCXT: The Backbone of Exchange API Integration

No matter how advanced your AI model may be, it needs reliable access to real-time order books and trade execution endpoints. This is where CCXT (CryptoCurrency eXchange Trading Library) shines. As the industry standard for exchange integration in Python and JavaScript projects, CCXT supports over 100 and exchanges, including Binance, Coinbase Pro, Kraken, as well as several leading DEX aggregators.

CCXT abstracts away the complexity of disparate exchange APIs into a unified interface. This not only accelerates development but also future-proofs your bot against breaking changes from exchange-side updates, a critical edge when managing live capital across multiple venues. In practice, developers often pair CCXT with Hummingbot or custom agents for streamlined connectivity and failover resilience.

Real-World Example: Autonolas Trading Agents in Action

If you want proof that multi-agent AI crypto bots are more than just theory in 2024, look no further than Autonolas Trading Agents. Deployed live on Ethereum and Polygon mainnets, these agents operate autonomously, processing on-chain data feeds and executing trades based on collaborative decision-making logic. The Autonolas stack demonstrates how modular agent architectures can coordinate complex strategies such as cross-chain arbitrage or liquidity provision without human oversight.

This isn’t just academic; Autonolas showcases how decentralized governance can steer risk profiles dynamically based on collective intelligence from multiple sub-agents (e. g. , technical analysts working alongside news sentiment models). For anyone seeking a real-world blueprint for scalable cross-chain automation using open-source components, Autonolas provides invaluable insight, and a glimpse into where agentic DeFi is heading next.

For those serious about crypto trading bot development in 2024, combining these open-source frameworks is more than an efficiency play, it’s a necessity for staying competitive as liquidity fragments across chains and venues. A robust multi-chain AI trading bot isn’t just about executing trades; it’s about orchestrating data, intelligence, and execution in real time, with minimal latency and maximum reliability.

From Blueprint to Deployment: Best Practices for Building Your Own Trading Agent

Let’s distill the lessons from the leading frameworks and live deployments into actionable steps:

- Start with Modular Design: Use Hummingbot as your orchestration layer for trade execution, plugging in custom AI models or leveraging pre-built strategies.

- Leverage CCXT for Exchange Reach: Integrate CCXT to unify access to both CEXs and DEXs. This ensures your bot can pivot between venues based on liquidity, fees, or slippage in real time.

- Study Real-World Agentic Deployments: Analyze how Autonolas Trading Agents utilize decentralized coordination and composable sub-agents. Consider adopting similar logic if you plan to scale your bot or incorporate collective intelligence.

- Prioritize Security and Compliance: Open-source does not mean open-to-attack. Implement strict API key management, regular dependency audits, and compliance checks tailored to your jurisdiction.

- Iterate with Live Data: The market moves fast; so should your feedback loop. Backtest strategies using historical data from Hummingbot’s connectors, then transition to paper trading before risking capital.

What Sets These Tools Apart?

The synergy between Hummingbot’s modularity, CCXT’s exchange reach, and Autonolas’ agentic automation forms a foundation that is both extensible and battle-tested. Unlike black-box SaaS bots or walled-garden platforms, these open ecosystems empower you to audit every line of code, essential when deploying AI agents that handle real assets across multiple blockchains.

This transparency also fosters rapid innovation. Community-driven improvements mean you benefit from the latest integrations (such as new DEXs on emerging L2s) without waiting for proprietary vendors to catch up. For traders who demand both flexibility and control, this is a paradigm shift away from legacy “one-size-fits-all” solutions.

Looking Ahead: The Future of Cross-Chain Automated Trading

The pace of innovation in open-source AI trading frameworks shows no sign of slowing as we approach 2025. With Ethereum scaling solutions maturing and interoperability protocols gaining traction, the ability for bots to natively traverse chains will become table stakes rather than a niche feature. Expect more agentic systems like Autonolas to emerge, not just managing trades but coordinating lending, yield farming, or even DAO treasury operations autonomously.

If you’re ready to build your own trading agent or want inspiration from live deployments pushing the envelope today:

Top Tools & Examples for Multi-Chain AI Crypto Trading

-

Hummingbot: An open-source, multi-chain trading bot framework designed for algorithmic and high-frequency trading. Hummingbot supports integration with leading centralized and decentralized exchanges, enabling users to automate strategies across multiple blockchains. Its modular architecture and active community make it a popular choice for both developers and professional traders.

-

CCXT (CryptoCurrency eXchange Trading Library): A widely-used JavaScript/Python/PHP library that provides unified API access to over 100 cryptocurrency exchanges. CCXT enables seamless exchange API integration, making it essential for building bots that require real-time data and trading capabilities across multiple platforms and chains.

-

Autonolas Trading Agents: A real-world example of cross-chain AI trading bots deployed on Ethereum and Polygon. Autonolas agents leverage decentralized infrastructure to automate complex trading strategies, demonstrating the practical application of AI-powered, multi-chain trading in live blockchain environments.

The convergence of modularity (Hummingbot), connectivity (CCXT), and true autonomy (Autonolas) marks a new era for algorithmic traders willing to embrace openness. As always: steady hands win volatile markets, but now those hands can be digital too.