The landscape of crypto investing is undergoing a seismic shift in 2025, with agentic DeFi bots at the forefront of this transformation. No longer are digital wallets just static repositories for tokens; they are evolving into intelligent, autonomous agents capable of executing complex strategies, optimizing yields, and managing risk in real time. This new breed of AI trading agents is fundamentally reshaping how investors approach crypto portfolio automation, making sophisticated DeFi accessible to both newcomers and seasoned professionals.

Agentic DeFi Bots: Beyond Passive Portfolio Management

Traditional crypto wallets have long been criticized for their passivity. In 2025, however, leading platforms like Talisman are rewriting the rulebook by embedding AI agents directly into self-custody wallets. This means users can now automate cross-chain strategies, tap into dynamic yield opportunities, and rebalance assets without wrestling with the technical hurdles that once defined DeFi. According to Talisman’s roadmap, these built-in AI agents empower users to grow their portfolios while maintaining full control over their assets, a hallmark of the emerging DeFAI wallet movement.

This transition marks a profound departure from static asset storage toward active portfolio growth. The result? DeFi is no longer the exclusive domain of coders and power users; it’s rapidly becoming democratized through intuitive agentic interfaces.

Case Studies: Explosive Growth in Real-Time DeFi Agents

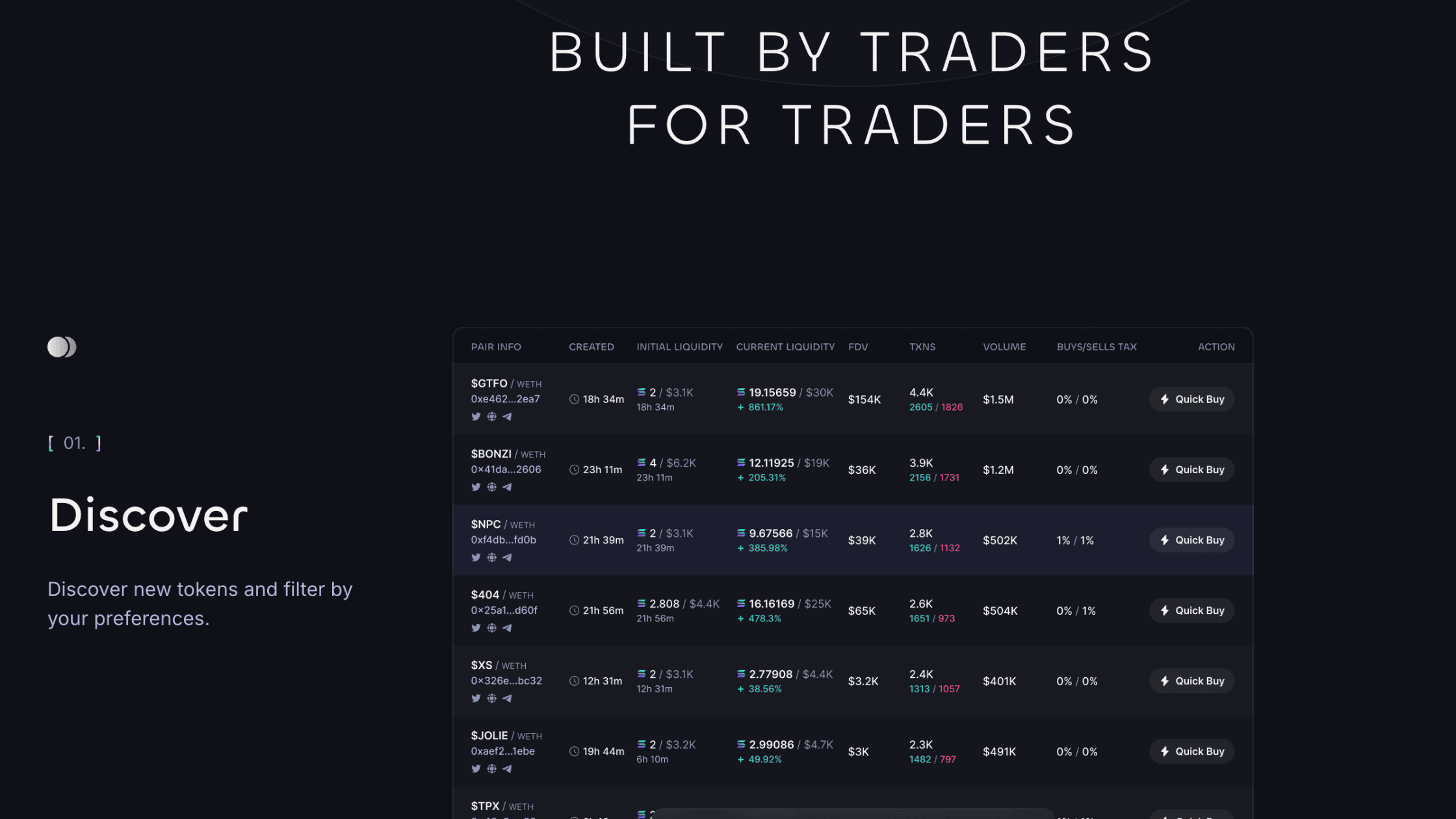

The impact of adaptive trading bots isn’t theoretical, it’s measurable. Consider the meteoric rise of several key agentic DeFi platforms:

Top Agentic DeFi Bots Revolutionizing Crypto Portfolios

-

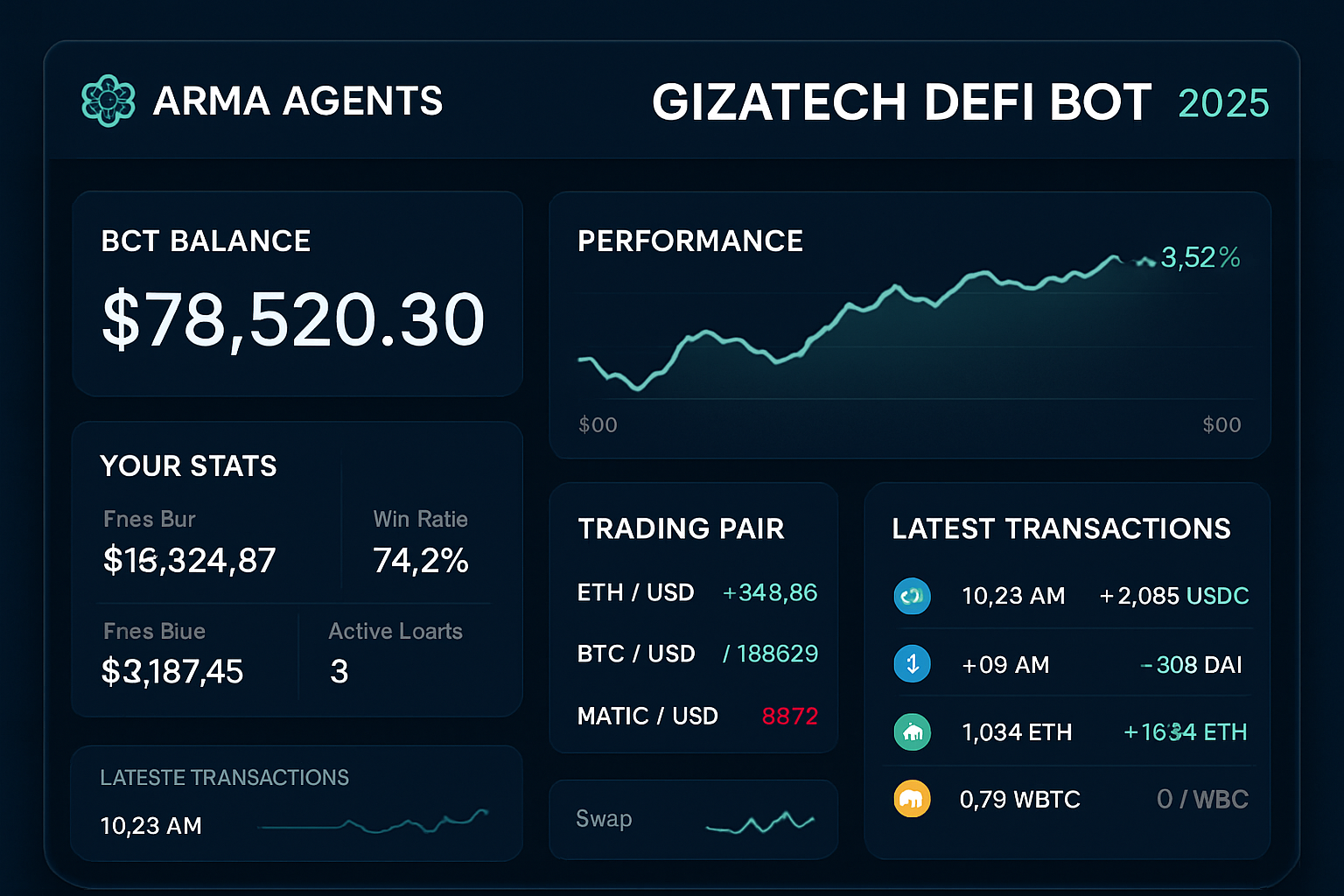

Arma Agents by GizaTech: Launched in November 2024, Arma Agents autonomously allocate USDC across leading DeFi platforms. Their TVL soared from $200,000 to $11.2 million (a 5,500% increase), while the user base grew from 2,600 to 33,000 agents in just seven months.

-

Morpho Agents by BrahmaFi: Debuting in January 2024, Morpho Agents optimize USDC and WETH across MorphoLabs vaults. TVL surged from $1.1 million to $9.5 million (a 760% rise), and users expanded from 353 to over 3,100 agents within half a year.

-

Fungi Agents on Base: Introduced in April 2025, Fungi Agents specialize in high-frequency rebalancing and gas efficiency. Their TVL jumped from $166 to $412,000 in under three months, with user adoption climbing from 10 to 216 agents in the same period.

- Arma Agents (GizaTech): Since launching in November 2024, Arma Agents have scaled from $200,000 to $11.2 million in total value locked (TVL), a staggering 5,500% increase. Their user base has expanded from 2,600 to over 33,000 agents within seven months.

- Morpho Agents (BrahmaFi): Debuting in January 2024, Morpho Agents grew TVL from $1.1 million to $9.5 million, a 760% leap, while their active user count surged from just 353 to more than 3,100 in half a year.

- Fungi Agents: Launched on Base in April 2025 with a focus on high-frequency rebalancing and gas efficiency, Fungi’s TVL soared from $166 to $412,000 in under three months as adoption ramped up from 10 to 216 agents.

This rapid adoption signals growing investor confidence in letting real-time DeFi agents shoulder the complexity of yield optimization and risk management across multiple protocols and chains.

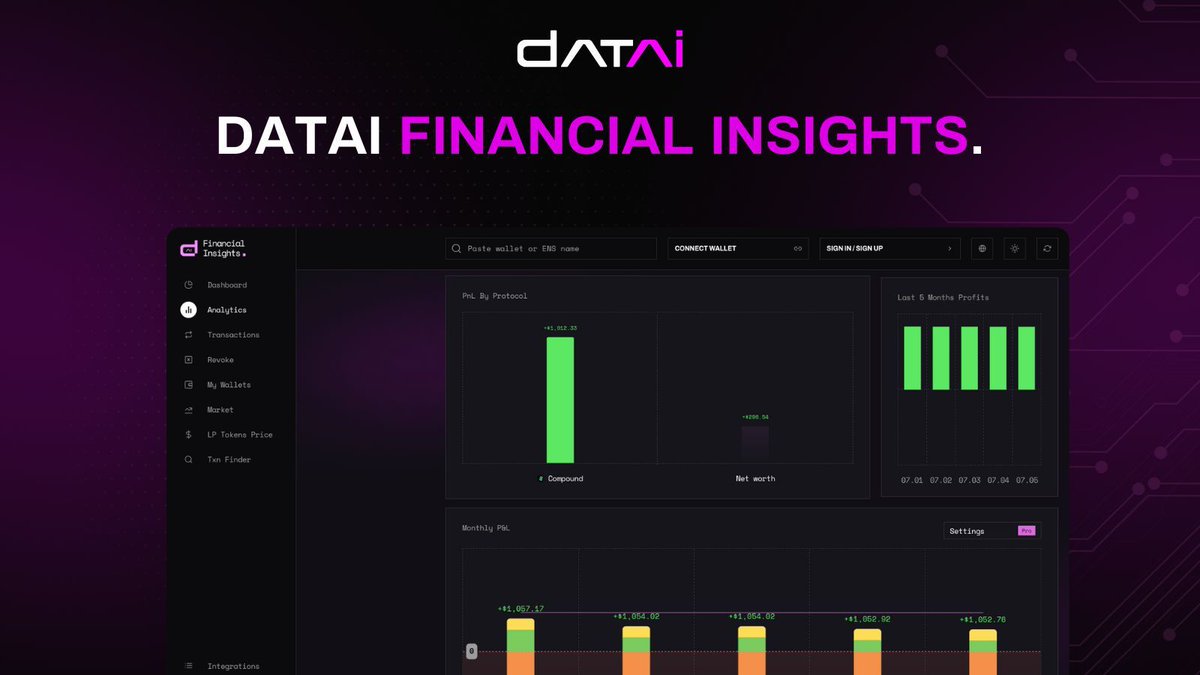

The Engine Under the Hood: How AI Empowers Cross-Chain Automation

The core strength of modern agentic DeFi bots lies in their ability to synthesize vast datasets, on-chain analytics, social sentiment feeds, liquidity flows, and act upon them instantly. Platforms like AgentLayer exemplify this trend by combining decentralized AI compute with capital-efficient strategies such as dynamic liquidity migration and arbitrage across ecosystems. By Q2 2025, AgentLayer had already attracted over $300 million in TVL thanks to its predictive stablecoin rotation bots and cross-chain arbitrage networks (see more here).

This technological leap is not just about speed but also about adaptability. Adaptive trading bots now use reinforcement learning algorithms that continually refine their approach based on live market feedback, a key reason why bot-driven portfolios outperformed both human-managed (18.7% return) and passive index trackers (13.2%), achieving an impressive average return of 28.9% during volatile periods between late 2024 and early 2025.

Pioneering Features Powering Agentic DeFi Platforms

- Self-improving strategies: Bots learn from every trade and market cycle.

- Cross-chain liquidity migration: Seamless movement between protocols for optimal yield.

- User-governed automation: Investors retain ultimate control while delegating execution to AI agents.

- Real-time risk management: Automated stop-losses and position sizing based on up-to-the-minute volatility data.

With these features, agentic DeFi bots are not just responding to market conditions, but actively shaping them. The rise of agent-to-agent economies means AI agents are now negotiating trades, providing liquidity, and managing on-chain governance autonomously. This evolution is driving a new era in crypto portfolio automation, where efficiency and precision are no longer the privilege of institutional desks but are accessible to any investor with a smart wallet.

Human vs. Machine: Performance Is No Longer Close

The recent backtest results are telling: while human-managed portfolios returned 18.7% and passive index trackers 13.2%, bot-driven strategies leveraging reinforcement learning on decentralized exchanges delivered a robust 28.9% average return (details here). These adaptive bots excelled particularly during micro-timeframe arbitrage events and major Ethereum Layer 2 airdrops, where milliseconds and data-driven execution made all the difference.

For retail investors, this performance gap is more than academic, it’s a signal that embracing real-time DeFi agents may be essential for staying competitive in an increasingly automated landscape.

Key Advantages of Agentic DeFi Bots in 2025

Key Advantages of Agentic DeFi Bots in 2025

-

Automated Portfolio Management: AI-powered DeFi bots like Arma Agents and Morpho Agents autonomously allocate assets (e.g., USDC, WETH) across multiple protocols, optimizing returns without manual intervention. This automation transforms wallets from passive storage to active, growth-focused tools.

-

Superior Speed and Efficiency: Agentic bots execute trades, arbitrage, and rebalancing at microsecond speeds, far surpassing human capabilities. For example, Fungi Agents on Base are designed for high-frequency rebalancing and gas efficiency, enabling rapid response to market changes.

-

Advanced Risk Management: Modern DeFi bots use AI-driven analytics to assess risk in real time. Tools like AgentLayer employ predictive models to dynamically migrate liquidity and rotate stablecoins based on inflation forecasts, reducing exposure to volatility.

-

Cross-Chain Access and Yield Optimization: Platforms such as Talisman integrate multichain AI agents, allowing users to access and optimize yields across various blockchains seamlessly, without the need for manual bridging or complex DeFi navigation.

-

Accessibility for Non-Coders: No-code platforms like YourGPT and user-friendly bots (e.g., Cryptohopper, 3Commas) empower non-technical users to automate strategies, manage portfolios, and interact with DeFi protocols through intuitive interfaces.

-

Demonstrated Outperformance: In recent backtests, bot-driven strategies using reinforcement learning on decentralized exchanges achieved 28.9% returns over six months, outperforming both human-managed portfolios (18.7%) and passive index trackers (13.2%).

Furthermore, the rapid TVL growth seen in protocols like AgentLayer (now over $300 million) is fueled by these bots’ ability to dynamically migrate liquidity and optimize stablecoin exposure based on predictive inflation models, capabilities that even experienced traders struggle to replicate manually.

The Road Ahead: Agentic DeFi Platforms Democratize Alpha

The implications for crypto investors are profound. As wallets like Talisman integrate built-in AI agents and platforms such as Morpho Agents or Fungi Agents lower technical barriers, we’re witnessing the democratization of advanced trading strategies that were once reserved for hedge funds or algorithmic desks. Investors can now:

- Diversify across chains: Seamlessly allocate assets between Ethereum mainnet, Layer 2s, and emerging ecosystems without manual bridging or swapping.

- Automate yield hunting: Let bots identify and migrate to the highest-yielding pools in real time, no spreadsheets required.

- Control risk proactively: Set custom parameters so AI agents execute stop-losses or rebalance based on volatility spikes or macro events.

- Participate in governance: Delegate voting power to trusted AI agents who analyze proposals and vote according to your preferences.

This shift toward agentic DeFi platforms is making crypto portfolio automation smarter, and more inclusive, than ever before. As AI trading agents continue to evolve from assistants into autonomous financial actors, expect even greater innovation at the intersection of machine intelligence and decentralized finance.