In 2025, AI trading agents are at the heart of a new era in DeFi portfolio automation. The convergence of advanced machine learning, on-chain data analytics, and cross-chain interoperability has enabled these autonomous bots to optimize portfolios in real time, minimize human error, and unlock sophisticated strategies once reserved for institutional desks. As digital asset markets become more fragmented and competitive, traders are increasingly turning to AI-powered solutions for an edge.

The Evolution of DeFi Portfolio Automation: From Scripts to Intelligent Agents

Autonomous trading bots are not new to crypto. However, the leap from simple rule-based scripts to today’s agentic DeFi platforms marks a seismic shift. Modern AI trading agents ingest massive datasets – from on-chain transactions and DEX liquidity pools to macroeconomic indicators and social sentiment – analyzing them in milliseconds. This enables continuous risk assessment and dynamic rebalancing across multiple protocols and blockchains.

Key 2025 trends include:

- Cross-chain automation: Bots now coordinate trades across Ethereum, Polkadot, Cosmos, and more, optimizing gas usage and arbitrage opportunities.

- Personalized yield strategies: AI agents tailor risk parameters and allocation models for individual users based on wallet history and stated objectives.

- Real-time risk management: Advanced models detect volatility spikes or liquidity crunches instantly, triggering protective actions like asset rotation or stop-losses.

This evolution is best illustrated by five standout platforms that are redefining what’s possible in DeFi automation this year.

Top 5 AI Trading Agents Transforming DeFi in 2025

-

Coinrule: Renowned for its AI-assisted rule-based trading automation, Coinrule empowers users to create custom strategies without coding. Its intuitive interface and advanced machine learning models help both beginners and professionals automate DeFi portfolio management and execute trades across multiple exchanges in real time.

-

Quadency: Quadency stands out with its all-in-one portfolio management platform that leverages AI to automate trading strategies, rebalance portfolios, and provide analytics-driven insights. Its seamless integration with top exchanges and DeFi protocols makes it a favorite for users seeking cross-platform automation.

-

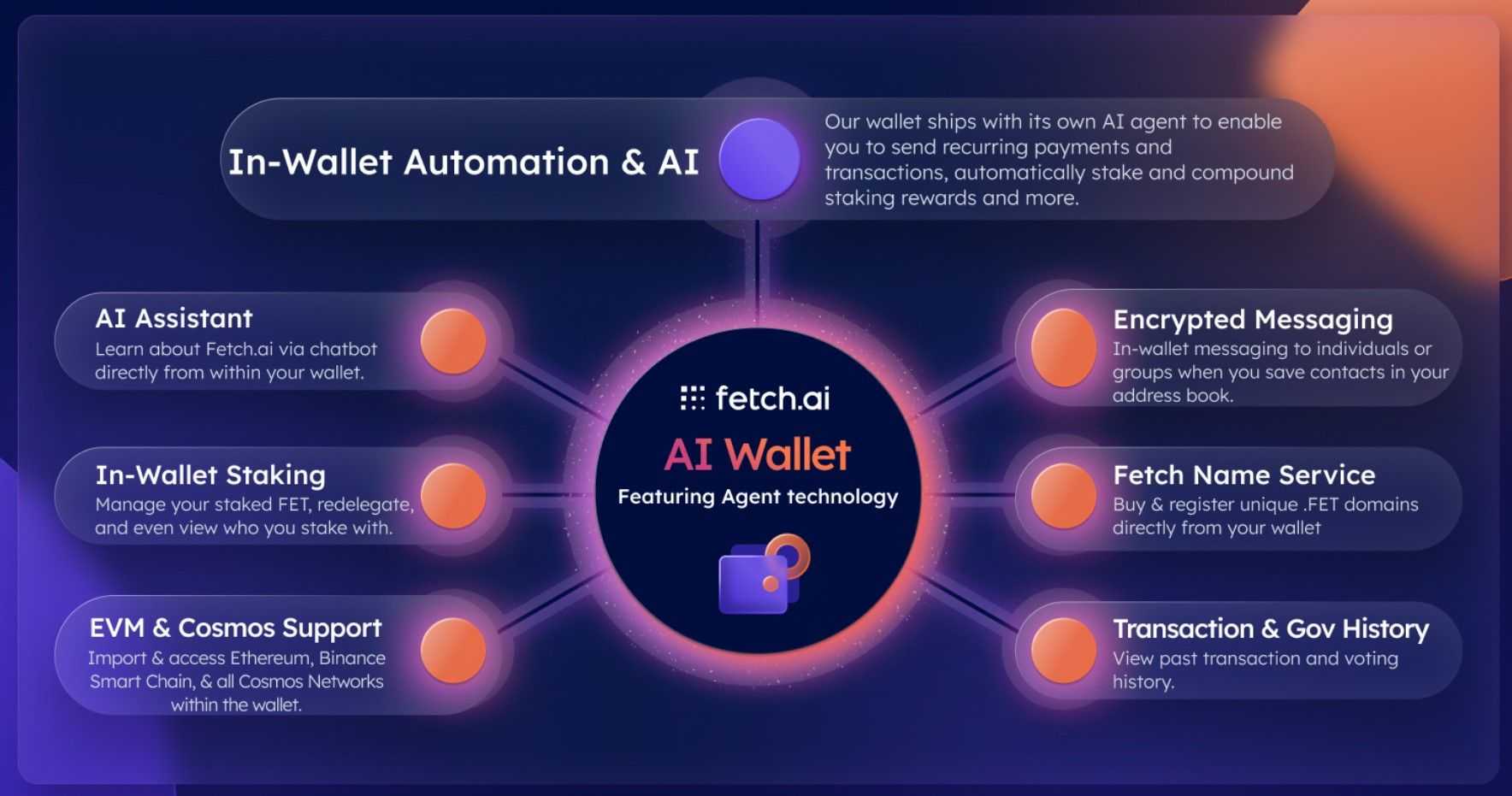

Fetch.ai: Fetch.ai is revolutionizing DeFi with autonomous AI agents that execute trades, optimize gas fees, and manage risk in real time. Its agents interact directly with decentralized exchanges and lending protocols, enabling users to capitalize on market opportunities faster than ever before.

-

Token Metrics AI: Token Metrics AI offers AI-powered analytics and automated portfolio optimization. By analyzing vast datasets and predicting market trends, it helps users maximize profits and manage risk, making sophisticated DeFi strategies accessible to a broader audience.

-

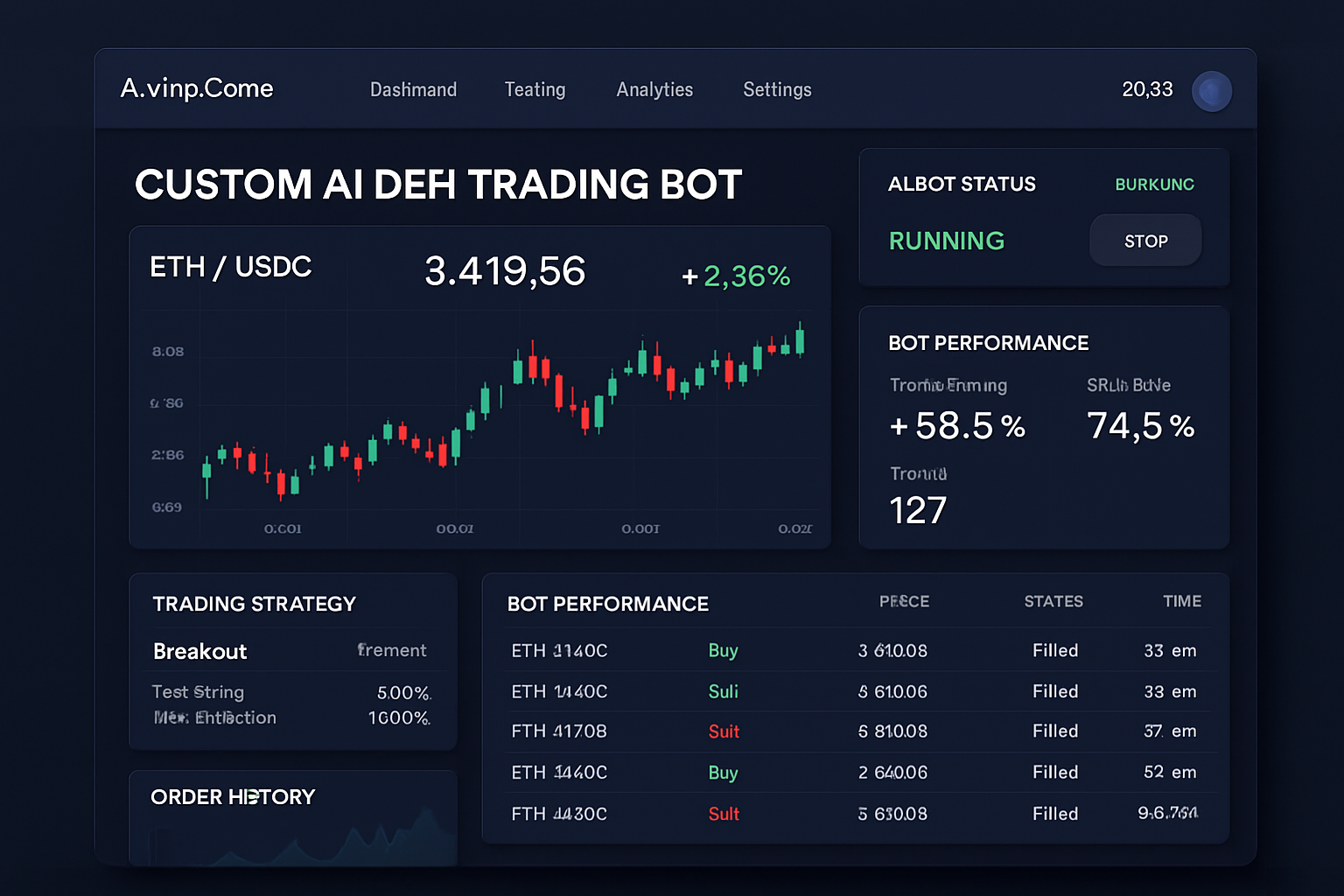

AmpCome Custom AI Trading Bots: AmpCome specializes in bespoke AI trading bots tailored for DeFi portfolio automation. Its expert development team builds custom solutions for yield farming, arbitrage, and multi-chain strategies, providing users with advanced automation and risk controls.

The Top Five AI Trading Agents Powering DeFi in 2025

1. Coinrule: Known for its intuitive rule-based engine enhanced with AI pattern recognition, Coinrule empowers both novice and pro traders to automate complex strategies without coding. In 2025, its integration of deep learning modules enables real-time adaptation to market regime shifts – a major advantage during periods of high volatility or sudden news events. Coinrule’s drag-and-drop interface remains a favorite among those seeking flexibility without sacrificing sophistication.

2. Quadency: Quadency stands out with its portfolio-level analytics dashboard powered by proprietary machine learning algorithms. The platform aggregates assets across centralized exchanges (CEXs) and decentralized protocols (DEXs), providing unified performance tracking and automated rebalancing. In the current landscape where cross-platform exposure is common, Quadency’s smart allocation engine helps users maximize returns while minimizing drawdowns through predictive modeling.

3. Fetch. ai: Fetch. ai brings agentic intelligence directly onto the blockchain via autonomous economic agents (AEAs). These agents can execute trades on your behalf, optimize gas fees dynamically, manage staking yields across protocols like Aave or Curve, and even participate in governance voting – all without manual intervention. Fetch. ai is recognized for its ability to interact not just with financial primitives but also with broader Web3 ecosystems (see details).

The Next Generation: Token Metrics AI and AmpCome Custom Bots

4. Token Metrics AI: Leveraging natural language processing (NLP) alongside quantitative analysis, Token Metrics’ AI platform delivers actionable insights for both short-term trades and long-term portfolio construction. Its models scan whitepapers, GitHub commits, social sentiment trends, and on-chain flows to generate predictive scores for thousands of tokens – helping users identify alpha before it becomes consensus (source). In 2025’s crowded market landscape, this data-driven approach is invaluable for filtering noise from signal.

5. AmpCome Custom AI Trading Bots: For users seeking tailored solutions beyond off-the-shelf bots, AmpCome offers bespoke development services that integrate cutting-edge machine learning into custom trading workflows (learn more). Their team collaborates closely with clients to encode unique risk tolerances or proprietary signals into fully autonomous agents capable of executing complex multi-step DeFi maneuvers – from flash loan arbitrage to liquidity mining optimization.

Navigating Challenges: Security and Data Reliability Remain Paramount

The proliferation of cross-chain AI bots brings new challenges around security and data reliability. Flash loan attacks remain a persistent threat; robust auditing practices and real-time anomaly detection must be standard features for any serious agentic platform operating at scale (more here). Additionally, as regulatory landscapes evolve globally in response to the rise of autonomous finance tools, compliance modules built into these bots will become increasingly important for both retail users and institutional clients alike.

While the promise of fully autonomous DeFi portfolio management is compelling, users must remain vigilant about the underlying risks. Data integrity is a critical factor: AI trading agents depend on real-time feeds from oracles and on-chain analytics to make split-second decisions. Any lag or manipulation in these data sources can lead to suboptimal trades or, worse, exploit vulnerabilities. As a result, leading platforms like Coinrule and Quadency have doubled down on integrating redundant data channels and implementing fallback protocols to ensure continuous, reliable operation even during periods of network congestion or oracle outages.

Security also takes center stage as AI agents increasingly control larger sums in decentralized environments. Fetch. ai and AmpCome Custom Bots both prioritize advanced security frameworks, employing multi-signature authentication, hardware wallet integration, and ongoing smart contract audits. These measures help mitigate the risk of unauthorized access or code exploits that could compromise user funds.

Regulatory clarity remains an evolving concern in 2025. As more jurisdictions scrutinize algorithmic trading in DeFi, platforms are proactively building compliance features such as transaction monitoring and automated KYC/AML modules. Token Metrics AI stands out for its transparent reporting tools that allow users to maintain audit trails for every automated trade, a feature gaining traction among institutional investors seeking regulatory alignment without sacrificing efficiency.

What’s Next for Agentic DeFi Platforms?Personalization at Scale

The next wave of innovation centers around personalized agent networks. By leveraging user-specific wallet histories, behavioral analytics, and stated risk preferences, platforms like AmpCome are developing agents that act as individualized financial advisors, constantly adapting strategies based on changing goals or market conditions. This shift towards user-centric automation not only democratizes access to sophisticated tools but also enhances portfolio resilience against market shocks.

The increasing adoption of cross-chain protocols will further expand the reach of these AI agents. In 2025, seamless movement of assets between Ethereum, Polkadot, Cosmos, and emerging chains is no longer a future vision but a daily reality for active traders using Quadency or Fetch. ai. This interoperability unlocks new arbitrage opportunities while minimizing systemic risk through diversified exposure.

Key Takeaways: AI Agents Are Reshaping DeFi Portfolio Management

In summary, the top five AI-powered trading agents provides Coinrule, Quadency, Fetch. ai, Token Metrics AI, and AmpCome Custom Bots: are setting new standards for efficiency and sophistication in DeFi portfolio automation:

- Coinrule: User-friendly rule-based automation with deep learning adaptation.

- Quadency: Unified analytics and predictive rebalancing across CEXs/DEXs.

- Fetch. ai: Blockchain-native autonomous economic agents optimizing trades/gas/staking/yields.

- Token Metrics AI: NLP-driven predictive scoring for smarter asset selection.

- AmpCome Custom Bots: Bespoke development for advanced multi-step strategies tailored to individual needs.

The rapid evolution of agentic DeFi platforms signals a future where anyone can harness institutional-grade portfolio management with minimal manual intervention, while maintaining robust security controls and regulatory readiness. For those looking to stay ahead in digital finance, understanding how these tools operate, and how they can be customized, is no longer optional but essential.