AI arbitrage trading in DeFi is no longer a theoretical edge reserved for institutional players. Modern AI-powered trading agents are systematically reshaping how price inefficiencies are detected and exploited across decentralized markets. By leveraging real-time data analysis, these agents operate at a speed and scale that simply outpaces manual strategies, making them indispensable for traders seeking alpha in today’s hyper-competitive landscape.

How AI Agents Identify Arbitrage in Decentralized Finance

At the core of every effective DeFi arbitrage strategy is the ability to rapidly spot price discrepancies for the same asset across multiple decentralized exchanges (DEXs) or blockchain networks. AI agents excel here by employing machine learning models trained on historical and live market data to scan thousands of trading pairs simultaneously. For example, platforms like CYNQ Ai deploy cross-chain bots that monitor both centralized and decentralized exchanges, flagging mismatches in asset prices as soon as they emerge. This level of surveillance is simply not possible with standard scripts or manual monitoring.

Top 3 Ways AI Agents Detect DeFi Arbitrage

-

1. Real-Time Cross-Exchange Price Monitoring: AI agents like CYNQ Ai’s Cross-Chain Arbitrage Bot continuously scan thousands of trading pairs across both centralized and decentralized exchanges. By leveraging machine learning, they instantly identify price discrepancies for the same asset on different platforms, enabling rapid detection of arbitrage opportunities.

-

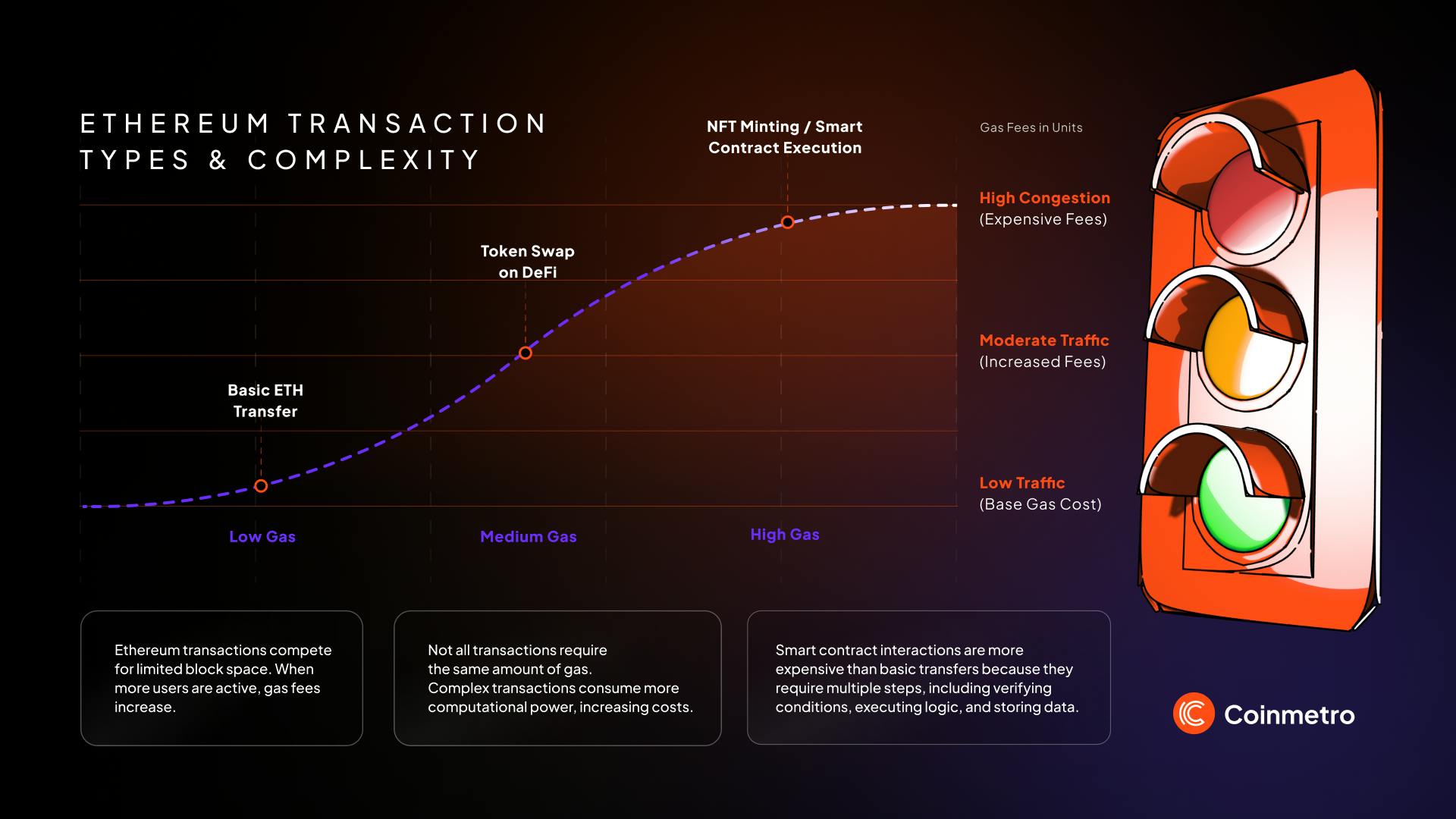

2. Liquidity Pool and Network Analysis: Advanced AI agents monitor liquidity pools on major blockchains such as Ethereum, Solana, and Avalanche. By analyzing trading volumes, liquidity depth, and real-time network congestion, they pinpoint situations where price differences are large enough to offset transaction costs, thus surfacing actionable arbitrage scenarios.

-

3. Automated Risk Assessment and Trade Execution: Platforms like DeFi Agents AI integrate risk management protocols into their AI agents. These systems assess potential risks such as slippage, front-running, and insufficient liquidity before executing trades, ensuring only viable arbitrage opportunities are acted upon and losses are minimized.

These AI systems ingest order book data, liquidity pool states, transaction volumes, and even mempool activity to estimate where an arbitrage window might exist. In practice, this means an agent can see when ETH trades at a slight premium on one DEX versus another or when a stablecoin depegs momentarily across chains. The sophistication lies not just in detection but also in filtering out false positives, many price gaps are illusory once you factor in slippage, gas fees, or network congestion.

Exploiting Arbitrage: From Detection to Execution

Detection alone is only half the equation. Once an opportunity is flagged, the real challenge is swift and cost-effective execution before the market reverts or others pile into the trade. Here’s where high-frequency trading techniques come into play: AI agents execute trades automatically within milliseconds, optimizing for gas fees and settlement costs along the way. A bot like CYNQ Ai’s arbitrage engine will not just route transactions through the cheapest paths but also dynamically adjust trade sizing based on current liquidity conditions, critical for avoiding losses due to slippage or failed transactions.

The best-performing crypto arbitrage bots with AI integration don’t just brute-force every opportunity; they apply predictive analytics to estimate which trades are likely to remain profitable after all costs are considered. This means factoring in volatile gas prices on Ethereum or congestion risks on Solana before committing capital, a level of nuance that sets advanced DeFi arbitrage AI agents apart from legacy bots.

Risk Management: The Unseen Pillar of Profitable Arbitrage

No discussion about DeFi arbitrage would be complete without addressing risk management, a domain where modern AI agents have made significant strides. These systems continuously analyze real-time market conditions to mitigate common pitfalls such as front-running (where other bots attempt to preempt your trade), sudden liquidity drains, or network outages that could leave trades partially executed and capital stranded.

For instance, before executing any trade, sophisticated bots will simulate expected outcomes based on current mempool data and adjust their strategies accordingly if they detect suspicious activity (e. g. , sandwich attacks). They may even throttle back position sizes during periods of heightened volatility or when network fees spike unexpectedly, proving that robust risk management protocols are not optional but necessary for sustainable returns.

It’s important to recognize that, despite their speed and analytical edge, AI-powered trading arbitrage agents are not infallible. The DeFi landscape is littered with failed bots that ignored slippage, underestimated gas volatility, or fell victim to protocol upgrades and black swan liquidity events. As a result, the most resilient DeFi arbitrage AI agents are those that incorporate layered risk controls: dynamic stop-loss logic, real-time liquidity checks, and adaptive trade throttling based on network health.

Technological Integration: Where AI Meets DeFi Infrastructure

The recent proliferation of agentic DeFi platforms like DeFi Agents AI demonstrates how far the industry has come in automating complex trading workflows. These platforms abstract away much of the technical friction for end-users by offering intelligent dashboards, customizable risk parameters, and seamless cross-chain execution, all powered by robust AI backends. For traders who lack the resources to build proprietary bots or monitor dozens of DEXs in real time, these solutions democratize access to high-frequency arbitrage strategies.

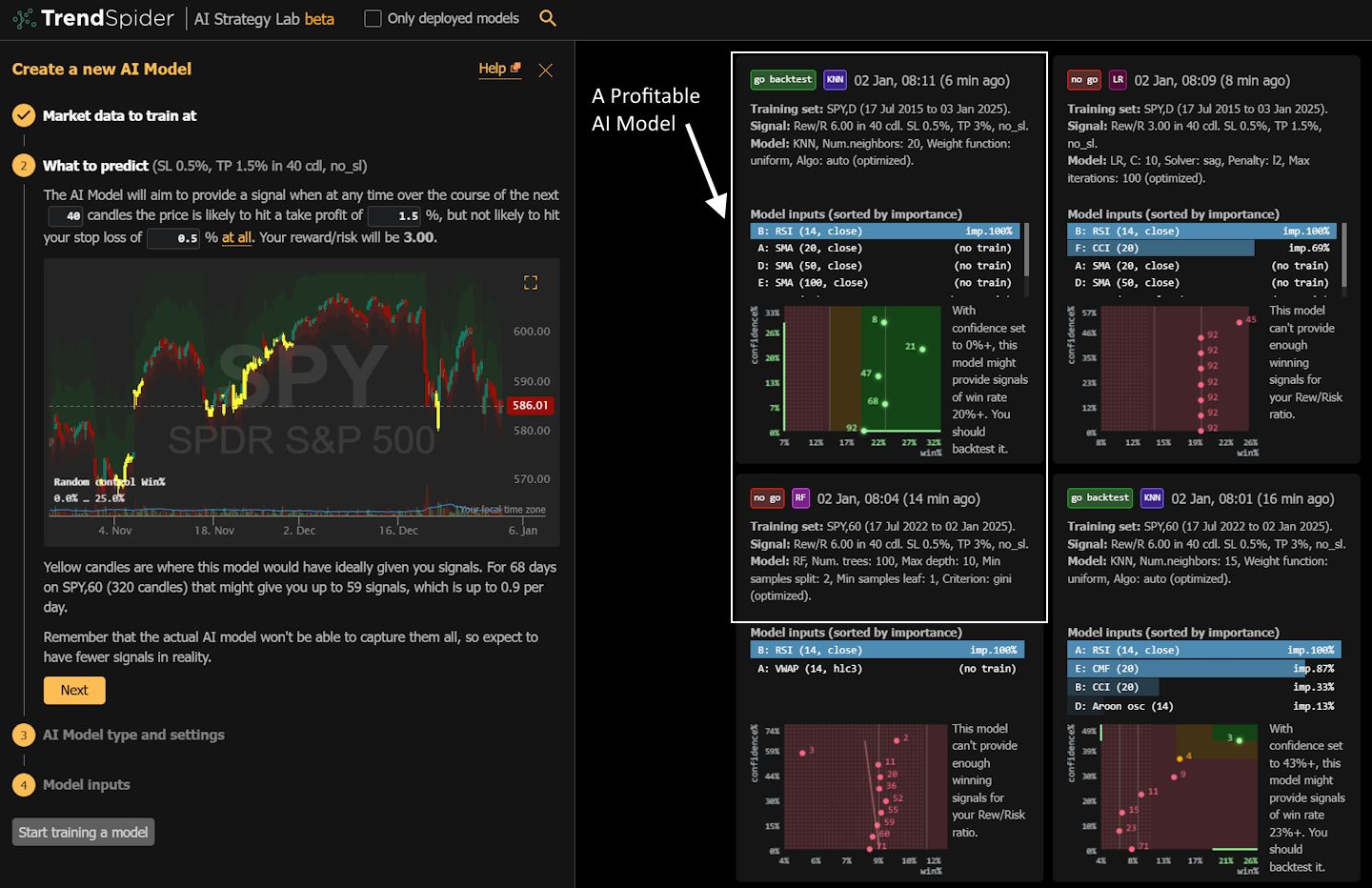

However, this convenience comes with its own set of trade-offs. Relying on third-party AI crypto arbitrage bots introduces platform risk and potential black-box opacity, a concern for anyone serious about capital preservation in an adversarial market. Rigorous due diligence is essential; always demand transparency on backtesting methodology, historical win/loss ratios, and fee structures before committing funds to any automated system.

Key Risks Before Using AI DeFi Arbitrage Bots

-

Front-Running and MEV Risks: AI bots may fall victim to front-running or Miner Extractable Value (MEV) attacks, especially on Ethereum and other public blockchains. Malicious actors can detect and preempt profitable trades, eroding arbitrage profits.

-

Network Congestion and Gas Fees: During periods of high network activity, such as on Ethereum, gas fees can spike unpredictably. This can render arbitrage trades unprofitable or cause transactions to fail, despite AI optimization.

-

Oracle Manipulation: Price oracles used by DeFi protocols can be manipulated, leading to inaccurate price feeds. Even robust platforms like Chainlink have faced oracle-related incidents, posing risks to arbitrage strategies.

-

Cross-Chain Bridge Risks: AI bots exploiting arbitrage across chains (e.g., using Synapse Protocol or Wormhole) are exposed to bridge exploits, downtime, or asset depegging.

-

AI Model Limitations and Overfitting: Machine learning models may overfit to past market conditions and fail to adapt to new patterns, leading to losses. No AI, regardless of sophistication, can guarantee future performance.

-

Regulatory Uncertainty: Jurisdictions such as the US and EU are rapidly evolving DeFi regulations. AI-powered bots may inadvertently violate new compliance rules, leading to potential legal consequences.

The Future: Smarter Agents and Adaptive Arbitrage

Looking ahead, expect further convergence between advanced AI models (such as reinforcement learning agents) and decentralized finance protocols. Next-generation bots will not only detect fleeting price gaps but also anticipate them, learning from order flow patterns or even exploiting latency differences across Layer 2 networks. As composability improves and data feeds become more reliable across chains like Ethereum, Solana, and Avalanche, the arms race for alpha will shift from raw speed to predictive intelligence.

The reality is that as more capital flows into DeFi, and as more participants deploy increasingly sophisticated crypto arbitrage bots with AI, the easy profits will evaporate quickly. Margins compress as inefficiencies close; only those willing to continuously iterate on their models and adapt to evolving market microstructures will thrive.

If you’re considering deploying an AI-powered trading arbitrage strategy in today’s DeFi markets, skepticism is your best ally. Don’t trust any system that promises guaranteed returns or ignores the ever-present risks of smart contract exploits or flash loan attacks. Instead, focus on platforms with a proven track record, like CYNQ Ai: and prioritize transparency at every step. The intersection of machine intelligence and decentralized finance offers remarkable promise but rewards only those who approach it with rigor and caution.